What Does Best Broker For Forex Trading Mean?

What Does Best Broker For Forex Trading Mean?

Blog Article

Examine This Report on Best Broker For Forex Trading

Table of ContentsThe 7-Minute Rule for Best Broker For Forex TradingFacts About Best Broker For Forex Trading RevealedLittle Known Facts About Best Broker For Forex Trading.Our Best Broker For Forex Trading DiariesSome Of Best Broker For Forex Trading

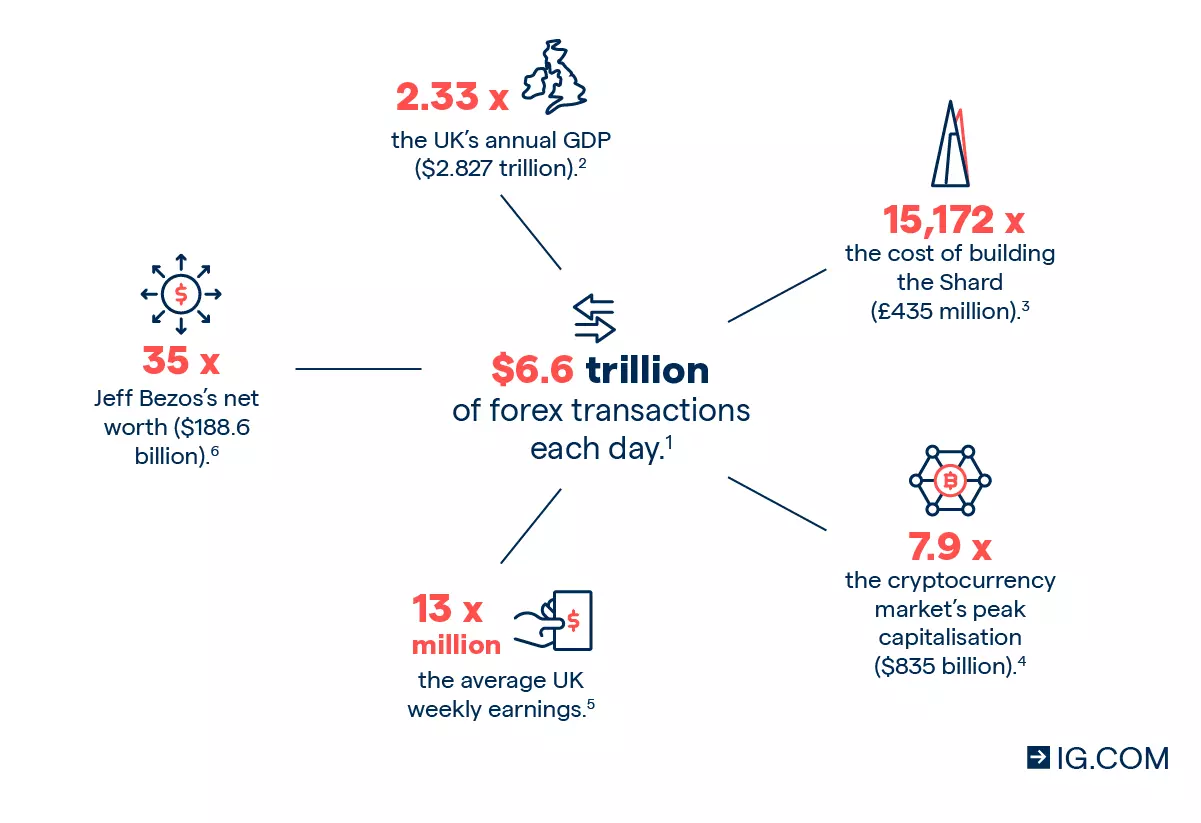

Trading foreign exchange involves at the same time buying one currency and offering one more. Currencies are sold pairs, e.g. the Euro against the United States Dollar (EUR/USD). The initial money in both is called the base currency and the second is called the counter or quote money. If the EUR/USD is trading at 1.14149, this indicates that 1 is worth $1.14149.Profile managers make use of the forex market to diversify their holdings (Best Broker For Forex Trading). Before beginning to trade forex, it is valuable to spend a long time learning more about the marketplace and elements such as the dangers of using utilize. There are numerous wonderful cost-free resources readily available online to help you with this, such as the education section of this site

Foreign exchange brokers based offshore commonly have very little regulative oversight and are extra dangerous to work with. Lots of brokers require very reduced minimum down payments to get started.

It may consist of some standard concerns regarding trading forex and CFDs. New foreign exchange traders ought to be aware of over night swap costs.

Everything about Best Broker For Forex Trading

Prior to trading in a live account it is a good idea to create a technique and examination it in a trial account. Additionally, micro accounts and adaptable whole lot sizes enable new investors to practice with actual cash while maintaining threat to a minimum. Starting a trading journal is a terrific practice for brand-new investors as it assists to identify strengths and weaknesses and track progression.

Trading based upon financial news is an instance of a basic method. An investor might be watching the US employment report and see it be available in even worse than the consensus anticipated by experts. They may after that choose to get EUR/USD based upon an assumption that the dollar will compromise on the unsatisfactory US information.

Searching for price breakouts in the direction of the prevailing market fad is an example of a technical trading strategy. The London Opening Range Breakout (LORB) is an example of such a technique. At the time of the London open, traders using this approach look for the rate of GBP/USD to burst out above a current high or below a recent low on the hourly graph with the expectation that price will certainly remain to trend in that direction.

Here traders look for certain chart patterns that show whether cost is likely to reverse or remain to fad parallel. The Pin Bar you can try this out is a prominent turnaround pattern. Below, cost gets to a brand-new high (or reduced) and after that reverses to shut near where it opened up, indicating an absence of sentence amongst the bulls (or bears).

What Does Best Broker For Forex Trading Do?

hold market settings for months and even years. Holding such long-lasting placements in the visit their website foreign exchange market has the prospective advantages of making money from significant price patterns and likewise being able to make rate of interest from a favorable rate of interest differential. One of the most preferred chart kinds in foreign exchange trading are Bar Graphes, Candle Holder Charts and Line Charts.

resemble Disallow charts in that they present the high, reduced, open, and closing costs for a set amount of time. Candle holders make it very easy for traders to understand whether the market is bullish or bearish within an offered period by tinting the area in between the open and close green or red.

Best Broker For Forex Trading - The Facts

just draw the line from one closing rate to the following closing rate. This graph kind makes it easy to see rate patterns yet uses little understanding into what happened over each period. Foreign exchange trading can be lucrative, yet the stats shared by significant brokerage companies reveal that the bulk of investors lose money.

It should likewise be emphasized that timing the marketplace and attempting to predict short-term moves in the market are extremely hard. Margin is the initial funding required to open and hold a leveraged position out there. As an example, a margin need of 1% corresponds to offered leverage of 1:100.

Not known Details About Best Broker For Forex Trading

The spread is the gap between the bid and deal (likewise known as 'ask') prices of a money set. This suggests that the finest cost that you can currently get EUR/USD is 1.14133 and the finest price you can presently market at is 1.14123.

A pipette is one tenth of a pip, generally in the fifth decimal area. Foreign exchange trading has crucial advantages and downsides compared to other markets. Current developments in the equities market, such as the development of fractional share trading and commission-free trading, have eroded some of the benefits of foreign exchange.

Report this page